Introduction

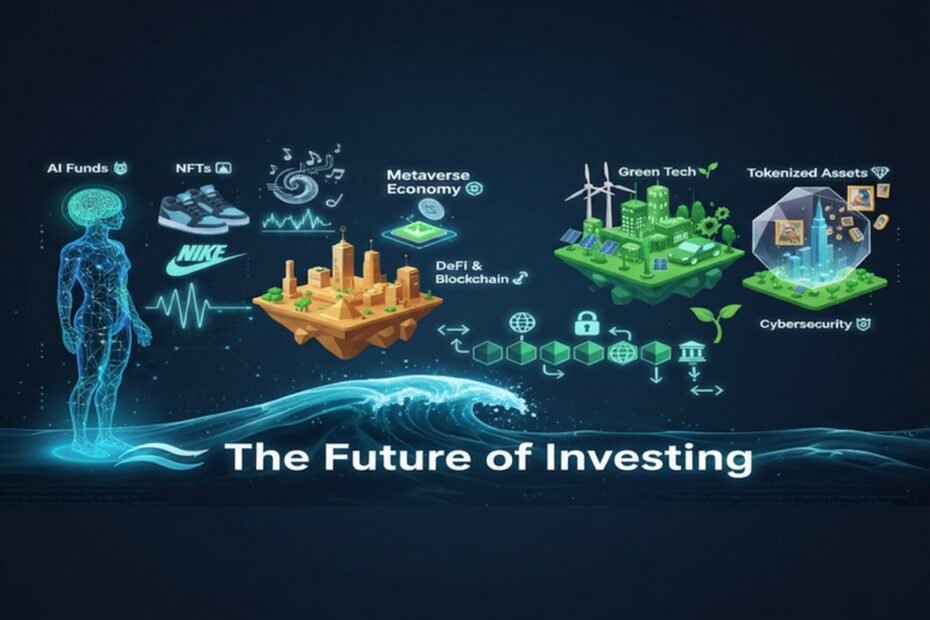

The investing world is changing faster than ever. The days are long gone when buying a few blue-chip stocks or some real estate properties would be enough to secure your financial future. Welcome to the era of digital investments, where in your portfolio you might have ether for an NFT (nonfungible token), a fund tracking artificial intelligence, assets from the metaverse and perhaps a stake in some real estate that was “tokenized” and turned into whatever cryptocurrency got hot.

The Movement from Conventional Assets to Digital assets

Our relationship with money has been thoroughly transformed by technology. Slow, traditional returns aren’t enough for millennials and Gen Z — they want speed, innovation, impact. Instead of focusing only on the stock market, they are divvying up their cash into crypto currencies, digital art, AI-powered portfolios and even virtual land.

Decoding the Digital Investment Boom 💡 Why is so much money flowing to digital companies during a recession?

It is not only the opportunity to make an investment that has never been more accessible than it is today. With a few taps on your phone, you can buy a tiny piece of a digital artwork or invest in an A.I.-powered exchange-traded fund. This democratization of investing —courtesy fintech platforms — are enabling a new generation to build wealth without the gatekeepers.

NFTs: Beyond the Hype 🎨

Non-Fungible Tokens (NFTs) have long been derided as the latest financial fad to be forgotten. But now, they’ve morphed into legitimate digital assets with real value. From music rights to gaming assets, NFTs are putting ownership in the digital era.

Imagine owning a unique digital sneaker from Nike or a track by your favorite musician. That’s what NFTs are — the ability to own, and access, things that only a few others in the world can.

The Metaverse Economy 🌐

The metaverse is not just a fantasy in science fiction anymore. Platforms such as Decentraland and The Sandbox are enabling investors to own, sell and monetize virtual land and experiences. Brands including Gucci and Adidas are already setting up digital shops there.

Purchasing land in the metaverse is analogous to buying Manhattan land in the 1800s — a risky, high-reward opportunity that may pay out astronomically.

AI Funds: How to Invest the Smart Way 🤖

It’s a revolution! And it will change the way we invest. AI-owered funds process thousands of data points in real time, making series market prediction at a stunning accuracy.

These are not your average mutual funds—they remove human bias and emotion from investment decisions, so you get with data-driven strategies that can outperform conventional models. Consider an indefatigable robo-adviser that never sleeps — and you’ve got the power of AI funds.

Blockchain & Decentralized Finance (DeFi) 🔗

DeFi platforms leverage blockchain to provide transparent, borderless financial services — no banks necessary. You can earn interest, borrow money, lend money and invest hands-free using smart contracts.

It’s finance without middlemen and day traders, operated entirely by code such that investors have full control.

Investment in Green & Sustainable Tech 🌱

Investing in the future is protecting the planet. ESG (Environmental, Social, Governance) funds and green tech stocks are being flooded with billions as more and more people strive to make profits illuminate their purpose.

Solar, wind and electric vehicle companies are no longer the fringe players — they’re the foundations of the next industrial revolution.

Cybersecurity Stocks: Safeguarding the Digital Gold 🛡️

As our wealth goes online, so do the dangers. That’s why companies that provide cybersecurity are thriving. Companies such as CrowdStrike and Palo Alto Networks are safeguarding the infrastructure of digital finance — cybersecurity is one of the most promising investment frontiers.

The Emergence of Tokenized Assets 💎

Imagine you owned 1% of a New York skyscraper or a Picasso. Tokenization enables this to happen by converting real-world assets into digital tokens.

That translates into more liquidity, lower barriers to entry and equal opportunities for the little guy.

How Gen Z and Millennials Are Changing Investing 👩💻

The next generation isn’t just investing — they’re investing with values and memes. They’re not afraid to take on Wall Street, as we saw with GameStop and Dogecoin.

They mine social media, AI tools and hacker forums to research and collaborate, spawning a kind of social revolution in investing.

Risk in the Next-Gen Investing Landscape ⚠️

High risk comes with high reward. Digital assets can be volatile and susceptible to scams. That’s why education and diversification are so important. Don’t keep all your crypto in one basket — balance innovation and stability.

How to Construct a Portfolio That Will Last

https://www.nytimes.com/2020/11/27/business/best-invest-manage-grow-money.html

Combining the stability of traditional assets and possibilities for growth afforded by digital ones. Consider a mix of:

- AI funds for intelligent data-driven growth

- Sustainable stocks for long-term value

- Innovating with NFTs and tokenized assets

An effective portfolio is a rocket: It needs both fuel (innovation) and stability (structure) to launch at all, much less fly.

The Future of Investing 🔮

In 2030 investments will be controlled by AI, blockchain and digital money. The winners will be the people who are willing to change early, instinctively — those who learn, experiment and iterate.

The future is not about chasing trends; rather we need to learn technology and make informed, ethical choices.

The new generation doesn’t just invest — they do so according to values and memes. They’re not afraid to stick it to Wall Street, as demonstrated by GameStop and Dogecoin.

Conclusion

The future of investing is digital, smart and all-encompassing. From NFTs and AI funds to startups with an eye toward sustainability, and tokenized real estate — there is plenty of innovation happening in the world of finance today.

Well, are you ready to get swept up on next-gen investing wave — or will you be watching it pass u by? 🌊